The Red Pill for Crypto Marketers: 5 Hard Truths About User Acquisition Beyond Coinzilla

A review of 5 popular crypto-traffic sources with all their good and bad.

For countless crypto marketers, launching a campaign begins and ends with a few familiar names. Coinzilla, as one of the largest Web2-focused crypto ad networks, is often the default choice. Boasting over a billion monthly impressions and a familiar CPM model, it represents the path of least resistance. Its roster of publishers—major crypto media outlets, price trackers like CoinGecko, and informational sites—looks impressive on a media kit.

Meaning, without specific targeting (which Coinzilla do not provide) 98% of the advertising budget will go directly to waste due to the impressions used by users that do not even have a wallet and do not use crypto assets.

However, this scale masks a critical, profit-draining flaw: the profound disconnect between impression volume and user quality.

The core issue lies in the audience itself. The vast majority of these Web2 websites, while rich in pageviews, are poor in on-chain intent. They are informational hubs, not transactional platforms. A user reading an article on "The Future of DeFi" is not necessarily a DeFi user. They might not even own a cryptocurrency wallet.

Consider this stark reality: A top-tier crypto news site might attract 100 million monthly visits, but the actual number of daily active on-chain wallets historically sits in the range of a few million (as per DappRadar and other analytics firms). This means that without hyper-specific targeting (which traditional Web2 networks like Coinzilla struggle to provide), a staggering 98% or more of your advertising budget is likely being spent on users who lack the basic qualification for using your product: an active wallet and the intent to use it.

You're not just paying for irrelevant clicks; you're funding a digital facade. This leads to abysmally low click-through rates (CTRs), minimal engagement, and a cost-per-acquisition (CPA) that makes sustainable growth impossible. Your dashboard might show "impressions," but your treasury shows an outflow with little to show in return.

This guide is the red pill. We will expose the limitations of the easy path and chart a course toward authentic, valuable user acquisition by exploring five powerful alternatives to Coinzilla, complete with their own sets of advantages and harsh realities.

1. The Web2 Fallacy: When "Crypto-Related" Isn't "Crypto-Capable"

The first alternative many consider is simply shifting budgets to other Web2 ad networks like Bitmedia or Cointraffic. On the surface, this seems logical. They operate on the same model, often even sharing similar publisher inventories, and they are notoriously lenient with token offerings and gambling ads.

The Bitter Truth:

You are playing a game of musical chairs within the same crowded, noisy room. You're competing for the same broad, often unqualified attention. These networks excel at generating volume—Bitmedia alone claims over 1 billion monthly impressions —but they inherit the same fundamental weakness: an audience that is passively informed rather than actively engaged.

The good:

Such solution have their benefits: they have a huge volume of traffic that you won’t be able to exhaust, and can sell it quite cheap. Also, they seem to have no limitations to working with token offerings and gambling ads.

The bad:

But they also inherit all the drawbacks of web2-native traffic, with its low quality, minimal engagement and bottom-low CTRs, and little relevancy for Web3 projects. As a result, they got used mostly for casinos and token pumps.

When to Use It: This approach can be marginally useful for top-of-funnel brand awareness campaigns for exchanges or wallets targeting the curious-but-not-yet-active crowd. It is virtually useless for performance-driven goals like driving protocol interactions, NFT mints, or dApp usage.

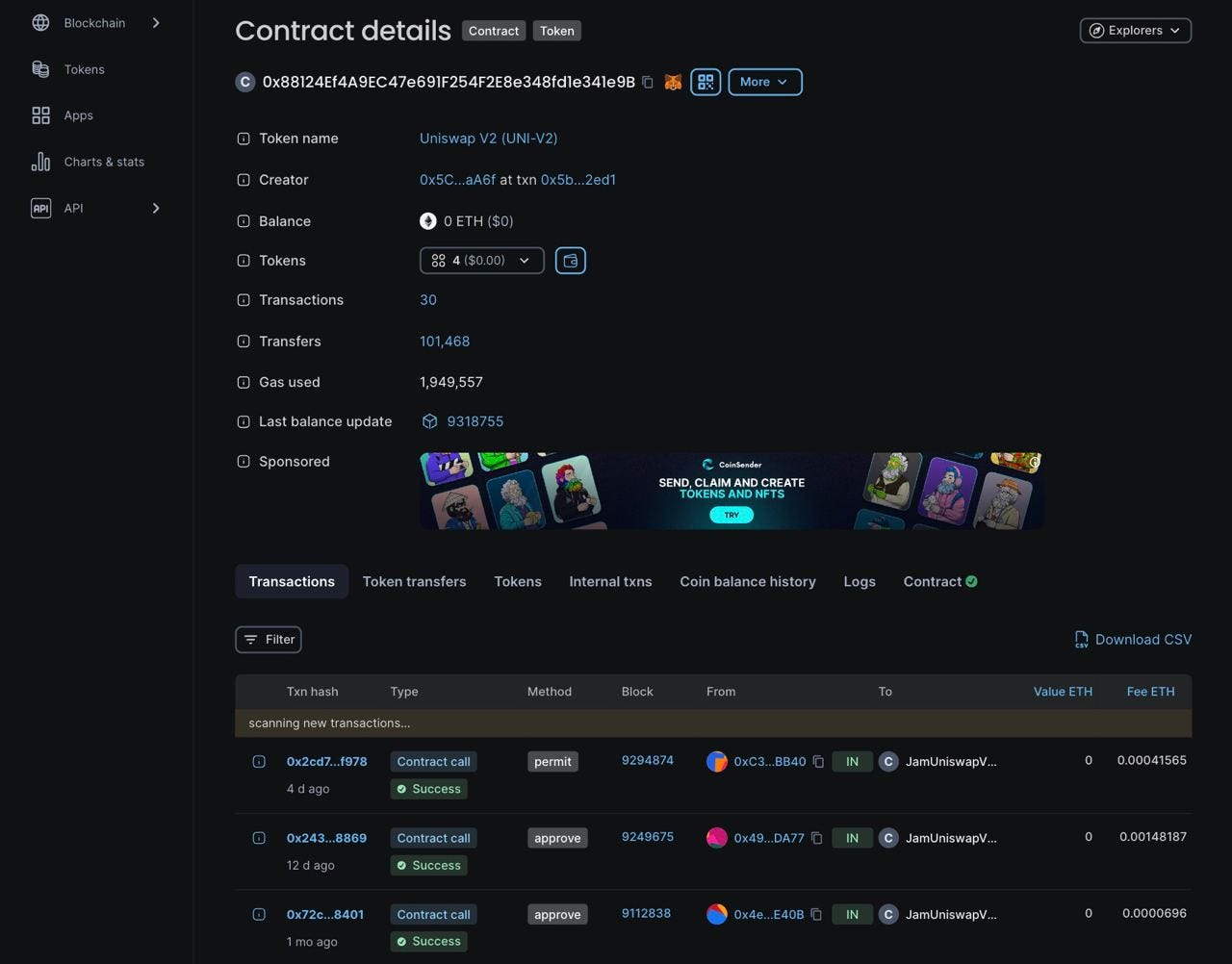

2. Web3-Native Advertising: Targeting the On-Chain Elite

This is the paradigm shift. Instead of chasing the masses on Web2 sites, Web3-native ad networks like Slise and the now industry-leading Blockchain-Ads flip the script. They focus exclusively on placing ads within dApps—the decentralized applications where real on-chain activity happens.

Think DeFi protocols like Uniswap or Compound, NFT marketplaces like OpenSea, blockchain explorers, Web3 games, and analytics dashboards. To even see an ad here, a user must have a connected wallet. This single requirement acts as a perfect filter.

The Audience: This is the 2 million-strong core of the crypto economy. They are not readers; they are actors. They hold assets, provide liquidity, trade NFTs, and govern protocols. Their lifetime value (LTV) is orders of magnitude higher than a casual reader's.

The Bitter Truth:

You pay a premium for this privilege. CPMs on these networks are significantly higher than on Web2 networks. Furthermore, the total reach is limited by the entire population of active on-chain users. You cannot scale to 100 million users here because they don't exist yet.

The good:

Highest-quality traffic of crypto-natives that is impossible to find otherwise, much higher CTR, and the possibility to do targeting based on the wallet history and onchain assets. High LTV of the acquired users for the project in comparison to users who don’t have crypto assets and have to be onboarded.

The bad:

Rather limited reach due to the small size of the whole Web3 space, and a higher price of CPM than in Web2 sources, which could go even higher for targeted segments. Although, it should be compared, and sometimes the price can be on par with traditional Web2 traffic.

When to Use It: This is the optimal channel for performance marketing. Use it for driving high-value actions: smart contract interactions, premium NFT minting, protocol deposits, and targeted user acquisition for B2B2C products (wallets, infrastructure). The case study of Blockchain-Ads driving a 340% increase in protocol interactions for Compound is a testament to its power.

3. Twitter ads

Twitter remains the unofficial town square of crypto. It's where news breaks, communities gather, and influencers hold court. Unlike Google and Meta, its advertising policies are far more accommodating to crypto projects.

The Bitter Truth:

Twitter is still a Web2 platform. While you can target users based on their interests (e.g., "follows Vitalik Buterin" or "interested in NFTs"), you are targeting their social persona, not their on-chain identity. A prolific crypto Twitter user might have a wallet with $10 in it, or they might be a bot farm designed to farm airdrops. The platform is also rife with spam and scams, which degrades overall user engagement with ads.

The good:

Good chance to find real crypto users with precise targeting, but expect that CPM in that case will be comparable to Web3 ads. Best place to promote your Twitter account and build a social presence. Less so acquire paying customers.

The bad:

Hard to segment real crypto-users from all the other users of twitter and especially bots. More often than not twitter accounts do not translate into active wallets and exist purely for social activity and rewards. A high amount of spam and scam that lower user engagement with paid ads.

When to Use It: Excellent for brand building, announcing news, and driving traffic to your website or Twitter profile. It's less effective for directly acquiring paying customers or driving on-chain actions unless paired with a very compelling offer and a highly optimized funnel.

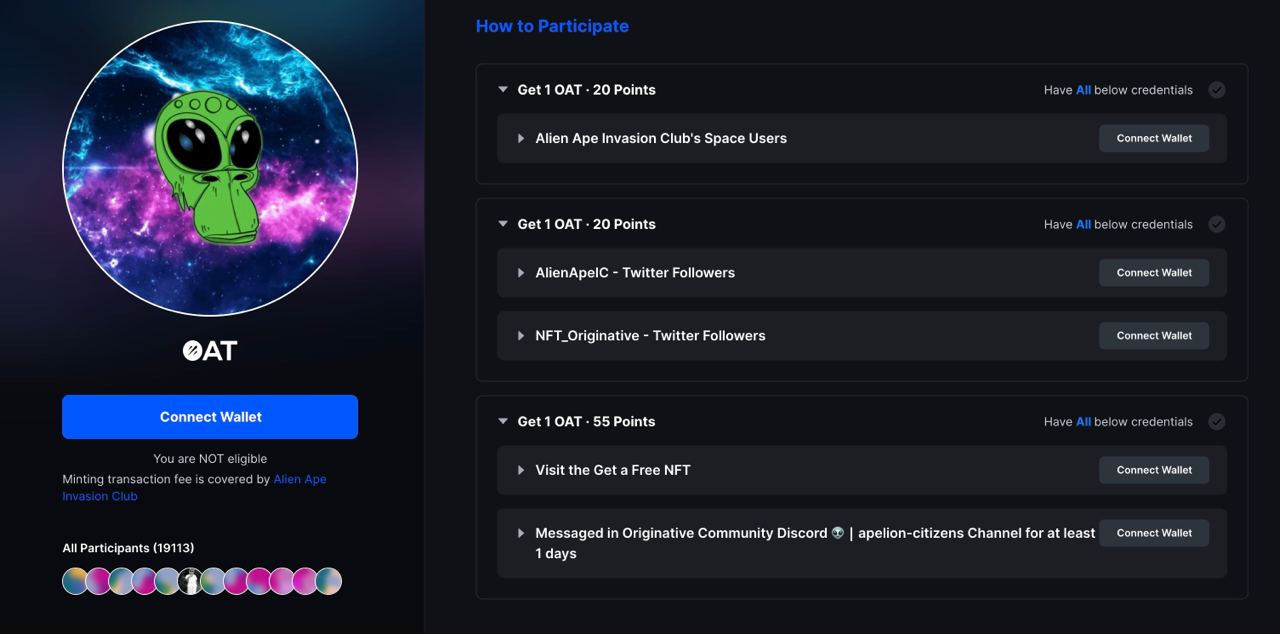

4. Rewarded-Quest Platforms: Buying Vanity Metrics

Platforms like Galxe, QuestN, and Zealy offer a seductive proposition: rapid user growth. They incentivize users to complete tasks (follow on Twitter, join Discord, make a small deposit) in exchange for points, tokens, or eligibility for future airdrops.

The Bitter Truth:

You are not building a user base; you are renting a mercenary audience. The vast majority of participants are airdrop hunters operating dozens of accounts and users from developing nations seeking micro-rewards. Whales, serious traders, and developers do not spend their days clicking through quests for petty rewards. The retention rate is catastrophic.

The good:

Very cheap cost of acquisition (CPA), and a quick way to bump up the vanity metrics for social proof or other needs. Ability to grow your social channels as well as your product.

The bad:

Close to zero retention and almost no difference from the bot traffic. Be assured, even that small fraction of real users that will come from quests will come for a reward, not for the product. Such users do not build a strong user base and do not improve important product metrics. Easy come—easy go.

When to Use It: Use it with extreme caution, only for specific, short-term goals like boosting initial Discord member numbers for social proof or running a known, one-off promotional campaign. Never consider it a core user acquisition strategy.

5. Doing an airdrop

Airdrops is by far the most mysterious user acquisition channel in crypto. The process implies spending money not on the traffic, but on the rewards to your existing users and expecting that a wider audience will get to know about it through word-of-mouth and will want to become your users to not miss another airdrop.

There are a lot of fundamental problems with the model, but what’s the worst, is that it actually works. For a crypto audience mostly driven by financial incentives and a chance to get rich, such an opportunity sounds really sexy, and the FOMO pushes even adequate users to simulate activity on a protocol to get the chance to receive the next drop.

To be more realistic, airdropping means giving away money, and not cents, as you would pay for an ad impression, but hundreds of dollars to a single user. How this works out in the CAC model nobody really counts, but hey, the numbers go brrr, just as with quests, making middle-level marketers looks genius for growing the KPI.

The good:

It’s an efficient way to grow your short-term user base via social FOMO and by “buying” users. Huge benefit: you can do it with your token and not real money, which is easier to print.

The bad:

Users that come for airdrop come for a reward, not your product, and they will leave even faster than they came once they are able to cash out that reward.

When to Use It: Airdrops should be treated as a strategic economic event, not a marketing tactic. They should be designed with vesting schedules, sybil resistance mechanisms (like those used by LayerZero), and a clear goal of rewarding true, loyal early users, not just anyone who performed a one-click interaction.

Conclusion: Building Authentically in a World of Quick Fixes

The path to sustainable crypto growth is not paved with vanity metrics and low-cost clicks. It is built by strategically investing in channels that deliver valuable, capable users.

The bitter truth is that quality acquisition is expensive and complex. There is no magic bullet. The winning strategy involves:

Audit Your Funnel: Know your true Cost to Acquire a Customer (CAC) and Lifetime Value (LTV). Without this, you're marketing in the dark.

Embrace Web3-Native Precision: Allocate a significant portion of your budget to networks like Blockchain-Ads that can target based on on-chain behavior. This is your highest-probability channel for real users.

Use Twitter for Community, Not Just Conversion: Leverage its reach for storytelling and brand building, but track how effectively it drives on-chain actions.

Avoid the Vanity Trap: Radically deprioritize quest platforms and unstrategic airdrops. Focus on retention, not just sign-ups.

Test and Iterate: The landscape changes monthly. Continuously A/B test your messaging, creatives, and channel mix.

In 2025, the crypto market is more competitive than ever. Survival doesn't go to the projects with the biggest marketing burn; it goes to those who are the most strategic, data-driven, and authentic in how they find and keep their users. Choose your channels wisely.

FAQ

What is the main difference between Web2 and Web3 ad networks?

Web2 ad networks (like Coinzilla, Bitmedia) place ads on informational websites (news, blogs). The audience is broad but unqualified, as most users do not have a connected wallet. Web3 ad networks (like Blockchain-Ads, Slise) place ads within functional dApps (DeFi protocols, NFT marketplaces). The audience is smaller but consists entirely of active, wallet-connected crypto users with a much higher intent to interact.

Why is Twitter not considered a Web3 platform for ads?

While Twitter is the social hub for crypto, its advertising platform is still built on Web2 infrastructure. It can target users based on interests and social graphs but lacks access to on-chain data. This means you cannot target users based on their wallet balance, NFT holdings, or transaction history, which is the most reliable indicator of a valuable user.

Are there any crypto ad networks with no minimum spend?

Yes, some networks are more accessible. Bitmedia and A-Ads are known for having no minimum deposit requirement, making them easier for smaller projects to test. However, remember that low cost often correlates with lower-quality traffic.

What is the most important metric for evaluating a crypto ad campaign?

While click-through rate (CTR) and cost-per-click (CPC) are useful, the only metrics that truly matter are on-chain conversions. This could be the cost to acquire a user who makes a deposit (CPA), completes a trade, or interacts with your smart contract. Tracking these requires on-chain analytics tools.

Can I use a combination of these channels?

Absolutely. A sophisticated strategy often involves a mix:

Web2 Networks: For broad, top-of-funnel awareness.

Web3 Networks: For high-intent, performance-driven acquisition.

Twitter: For community engagement and announcement amplification.

The key is to track each channel's contribution to your final on-chain goal, not just intermediate metrics like website clicks.