The 2025 Map of On-Chain Distribution: A Strategic Guide to Reaching Wallet Owners

The Paradigm Shift – From Web2 Analytics to Web3 Distribution

In the early days of Web3, the focus was squarely on on-chain analytics. Teams spent countless hours dissecting wallet data, creating intricate charts, and segmenting audiences based on transaction history, NFT holdings, and DeFi activity. But a critical question always remained: What do we do with this list of wallet addresses now?

The industry has since matured. The pioneers who built those analytics engines have diverged, applying their expertise to new frontiers. Some developed sophisticated Web3 CRMs, others built the analytics APIs that power the ecosystem, and a third group tackled the most challenging problem of all: the consumer-facing distribution layer—the actual art and science of reaching a wallet owner with a message.

This evolution marks a fundamental shift from passive analysis to active engagement. In 2025, simply knowing your audience is no longer a competitive advantage; it's table stakes. The true differentiator for Web3 growth teams is mastering the distribution channels that allow for precise, effective, and ROI-positive engagement with on-chain audiences.

This guide serves as your updated 2025 map to the landscape of on-chain distribution. We will explore the five primary channels to reach wallet owners, analyzing the realistic reach, strategic value, and critical pitfalls of each, empowering you to navigate beyond analytics and into actual growth.

The Core Challenge: Attention is the New Scarce Resource

The foundational principle of Web3 marketing is that on-chain data is behavioral data fused with financial data. A wallet's history is a transparent ledger of intent, loyalty, and capability. However, this rich data is useless if you cannot get your message in front of the wallet owner in a way that captures their attention and drives action.

The channels available for this task vary wildly in their scale, precision, and complexity. Choosing the right one is not just a tactical decision; it's a strategic imperative that will define your customer acquisition cost (CAC), lifetime value (LTV), and ultimately, your project's success.

The Five Channels of On-Chain Distribution – A Detailed Analysis

1. Permissionless Public Channels (Airdrops 2.0): The Spam Graveyard

The concept is seductively simple: acquire a list of target wallets and broadcast your message or token directly to them. This is the purest form of permissionless, direct-to-wallet communication.

The 2025 Reality: This channel has largely collapsed under the weight of its own abuse. What was once a novel growth mechanism has become a vector for spam and scams. In response, wallet providers and dApps now aggressively filter and hide these unsolicited messages to protect users. The result? Abysmal impression rates and near-zero ROI.

Realistic Coverage: Next to nothing. Your message is likely to be automatically flagged and never seen.

Key Players (2025 Update): While projects like Venly and Novel attempted to build here, the model has proven commercially unviable. The space has moved on.

Strategic Lookout Points:

Creative Bypass: Has a project developed a truly novel way to bypass spam filters and reach a user's primary interface? Most haven't.

ROI Transparency: Since tracking views is nearly impossible, demand clear, auditable case studies on click-through rate (CTR) and conversion against budget. If they can't provide it, steer clear.

Verdict: In 2025, this is a channel for gamblers, not growth marketers. Avoid it for any serious user acquisition strategy.

2. Owned & Operated Platforms (Direct-to-Wallet Messengers): The Scale Problem

This approach involves building a dedicated platform where users willingly connect their wallets to receive messages, often in exchange for some utility or reward. Think of it as a Web3-native inbox or notification center. Projects like Dispatch and DeBank Hi pioneered this model.

The 2025 Reality: The fundamental challenge remains achieving critical mass. Building a large, active user base on a new platform is incredibly difficult in Web3. Any viable adtech business requires millions of monthly active wallets (MAW) to be a meaningful distribution channel. Furthermore, if the platform's sole purpose is to deliver ads, users simply won't use it. Success requires embedding ads within another must-use product (e.g., a portfolio tracker, a news aggregator, or a social platform).

Realistic Coverage: Tens to hundreds of thousands of Unique Active Wallets (UAW). A respectable niche, but not mass-market.

Key Players (2025 Update): The landscape has consolidated. Some early players have pivoted, while others have been absorbed into larger suites of tools.

Strategic Lookout Points:

Real MAW Figures: Scrutinize claimed user numbers. Ask for verified, on-chain proof of active engagement, not just download counts.

Cost Analysis: Advertising here is often prohibitively expensive. For example, DeBank Hi has been known to command a $1000+ CPM. You must calculate if the LTV of the acquired users justifies this extreme cost.

Chain Agnosticism: Is the traffic limited to a single chain (e.g., Ethereum-only), or does it provide cross-chain reach relevant to your strategy?

Verdict: A potential high-cost, high-precision channel for reaching a specific, engaged niche. Demand absolute clarity on actual reach and costs before committing.

3. The Metaverse (Virtual Worlds): The Premium Niche for Branding

The "Metaverse" here refers to blockchain-based virtual worlds like Decentraland and The Sandbox where users own digital assets. Advertising involves placing branded billboards, building virtual experiences, or sponsoring events within these worlds.

The 2025 Reality: The grand vision of a billion-user metaverse has not yet materialized. Concurrently, user bases remain small. Furthermore, creating and placing ads is not as simple as uploading a banner; it often requires custom 3D development, making it expensive and lacking cross-platform compatibility.

Realistic Coverage: Thousands to tens of thousands of UAW. It's a boutique channel.

Key Players (2025 Update): Anzu, Landvault, and AdShares remain prominent players facilitating virtual land deals and ad placements.

Strategic Lookout Points:

True Activity: How many daily active users does the platform genuinely have? Does the ad solution have direct access to the user's wallet for targeting and measurement?

Development Overhead: Will you need to hire a dedicated development team to create your virtual ad placement? This can add significant time and cost.

Tracking Capabilities: How will you track impressions, clicks, and conversions? Is there a clear analytics dashboard, or are you buying a "brand experience" with no measurable ROI?

Verdict: An overpriced niche channel for brand awareness and "clout" rather than performance marketing. Only consider it if your goal is prestige branding within a very specific community and you have a budget to match.

4. Decentralized Applications (dApps): The Workhorse of Web3 Advertising

This is the largest and most effective channel for performance-based marketing in Web3. Ad networks like Slise (now part of W3M Ventures) and Blockchain-Ads act as intermediaries, aggregating inventory from thousands of dApps—DeFi protocols, NFT marketplaces, blockchain explorers, and gaming platforms—and allowing advertisers to buy targeted placements across them.

The 2025 Reality: This channel wins on quality and intent. To even see an ad, a user must have a connected wallet, meaning every impression is delivered to a verified, active crypto user. The targeting is unparalleled: you can target based on wallet history, token holdings, and specific on-chain behaviors. The main limitation is the total size of the on-chain audience, though it's growing steadily.

Realistic Coverage: Millions to tens of millions of UAW. This is where the core Web3 audience lives.

Key Players (2025 Update): The industry has consolidated. Slise's acquisition by W3M Ventures has created a powerhouse combining on-chain data with traditional crypto ad inventory (like AADS). Blockchain-Ads is another major player, offering robust targeting and reporting.

Strategic Lookout Points:

Network Reach: How many wallets on your target blockchain (e.g., Solana, Base, Arbitrum) does the network actually reach?

Targeting Sophistication: Are you paying for blunt CPM, or can you leverage precise on-chain behavioral targeting to maximize ROI?

Publisher Quality: What are the dApps in the network? Are they reputable, high-traffic sites, or a long tail of low-quality inventory? Demand transparency.

Verdict: The essential channel for any performance marketer in Web3. It offers the best combination of reach, targeting precision, and measurable ROI for acquiring high-intent users.

5. Finding Web3 Users on Web2 Platforms: The Frontier of Scale

This is the most technically complex but potentially highest-reward channel. It involves using on-chain data to target users on traditional Web2 platforms where they don't have their wallets connected—like Twitter, crypto publications, and programmatic ad networks.

The 2025 Reality: Solutions like Addressable have matured significantly. They use advanced heuristics to anonymously connect wallet addresses to social media profiles and other Web2 identifiers. This allows you to create a lookalike audience of your best wallet-based customers and target them with ads on major social platforms, effectively bridging the Web2-Web3 gap.

Realistic Coverage: Millions to hundreds of millions of users. This is the channel for mass-scale reach.

Key Players (2025 Update): Addressable is the leader in wallet-to-social targeting. Furthermore, platforms like Quest3 and Premint, while primarily used for giveaways, are effectively harvesting Web2 identifiers (Twitter, Discord, email) that could be used for future targeted outreach.

Strategic Lookout Points:

Apples-to-Apples Comparison: Different providers use different methods. Demand case studies with clear metrics on CTR, CAC, and overall ROI.

Traffic Quality: Is the audience made up of real potential users or just airdrop hunters and quasi-bots? Scrutinize the data.

Data Ethics: Understand how the data is connected. Is it done in a privacy-compliant way that won't damage your brand's reputation?

Verdict: The strategic growth channel for 2025 and beyond. It allows you to apply Web3 intelligence to Web2 scale, making it indispensable for projects looking to break out of the core crypto niche and into the mainstream.

Strategic Integration and Future-Proofing Your Growth Engine

Choosing a channel isn't an exclusive decision. The most sophisticated growth strategies in 2025 involve a sophisticated mix:

Precision Acquisition: Use dApp ad networks (Channel 4) to acquire your first 10,000 high-LTV, core users cost-effectively.

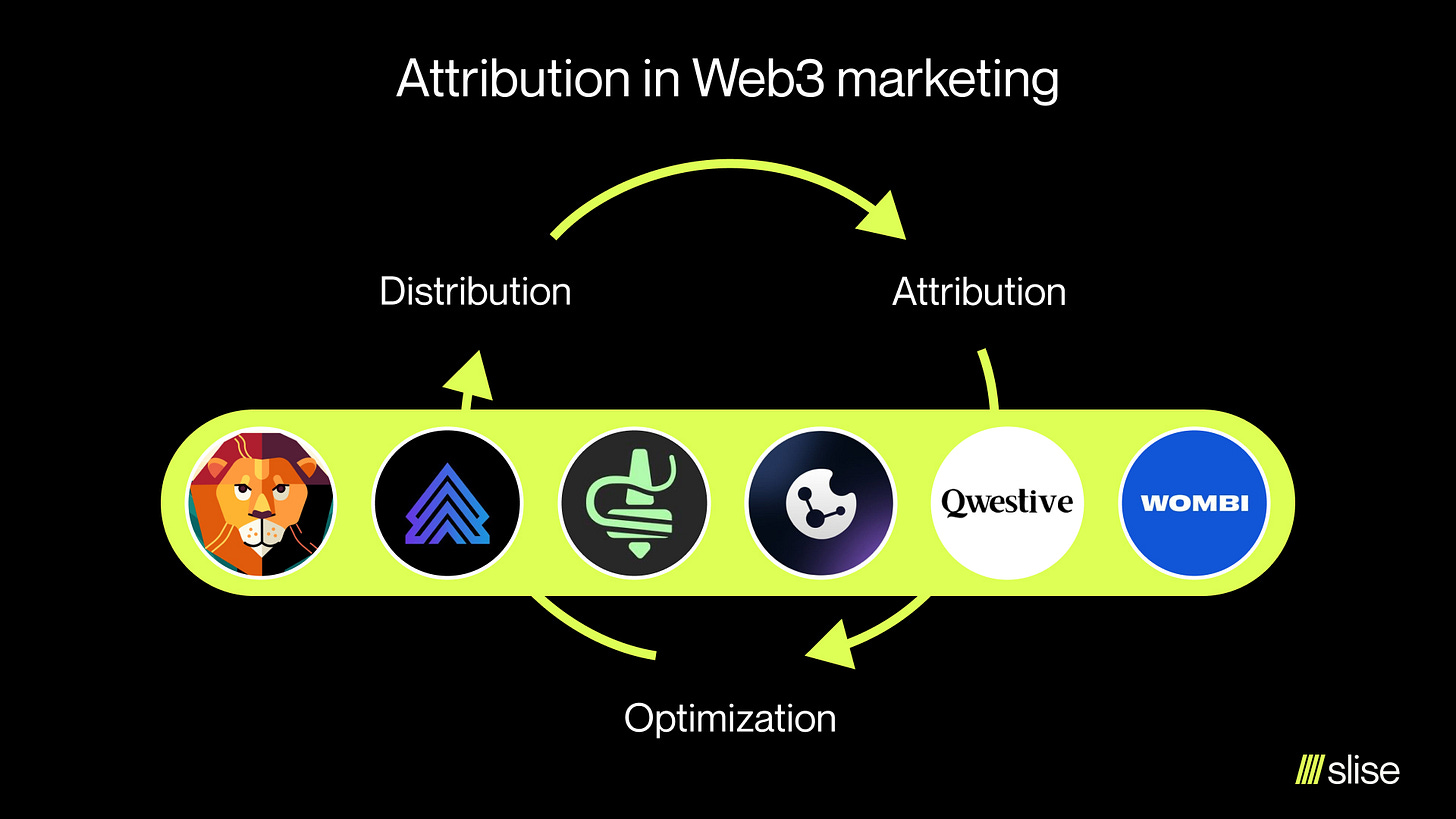

Audience Analysis: Analyze the on-chain and social behaviors of your best converts using tools like Cookie3 or Spindl.

Scaled Expansion: Feed these insights into a platform like Addressable (Channel 5) to find and target lookalike audiences at scale on Web2 social platforms.

This creates a powerful, data-driven feedback loop where your on-chain results directly inform your off-chain acquisition strategy.

Conclusion: Distribution is the Final Boss of Web3 Growth

The journey from raw on-chain analytics to effective distribution is the defining challenge of Web3 growth. The map is complex, and each path has its own costs and trade-offs.

The key takeaway for 2025 is this: Move beyond the spammy, one-size-fits-all approaches of the past. The future belongs to strategies that respect user attention, leverage quality inventory, and use data not just for analysis, but for intelligent, cross-channel execution.

By understanding the realistic capabilities of each distribution channel, asking the right tough questions of providers, and integrating these tools into a cohesive strategy, you can finally unlock the true promise of on-chain data: not just to see your audience, but to truly reach them.

FAQ

What is the most cost-effective channel for early-stage Web3 projects?

For early-stage projects targeting genuine users, dApp ad networks (Channel 4) are typically the most cost-effective. They allow for hyper-targeted campaigns to users who are already actively using wallets and dApps, ensuring higher intent and better conversion rates despite a smaller overall audience size than Web2 channels.

How can I track the ROI of on-chain advertising campaigns?

This requires Web3-native attribution tools like Spindl or Cookie3. These tools can track a wallet's journey from seeing an ad in a dApp to ultimately completing a desired on-chain action (e.g., a swap, mint, or deposit) days or weeks later, providing a true measure of LTV and campaign ROI beyond last-click attribution.

Can I use these channels for non-financial dApps, like Web3 games or social apps?

Absolutely. The principle is the same: target wallets based on relevant behavior. For a game, you might target wallets that hold specific gaming NFTs or have interacted with similar game smart contracts. For a social app, target wallets active on platforms like Lens or Farcaster. The targeting is behavioral, not limited to DeFi.

What's the biggest mistake projects make with on-chain distribution?

The biggest mistake is prioritizing low cost over quality. Opting for channels with cheap CPMs (like some airdrop platforms or unvetted quests) often leads to acquiring a large volume of low-intent, mercenary users who drain resources and provide no long-term value, destroying your CAC/LTV ratio.

Is email marketing still relevant in a wallet-based strategy?

Yes, but through a Web3 lens. Platforms like Quest3 collect emails as part of giveaway mechanics. While primarily used for untargeted outreach now, this harvested data has the potential to be used for targeted email campaigns in the future if platforms develop that functionality, allowing for a Web2/Web3 hybrid approach.